Rapaport : The price list of cut diamonds

The name Rapaport ‒ Rap(p)aport, Rap(p)oport or Rapa Porto ‒ comes from an Italian family of Jewish origin from Porto (Modena). The Rapaport Diamond Report constitutes the price list of cut diamonds. Wholesalers use it every day to be informed of changes in the price of diamonds. The Rapaport is issued every Friday and is used as a base to establish the price of diamonds that are sold individually. The price does not necessarily change from one Friday to the next.

Unlike white diamonds, coloured diamonds (Fancy colour) such as red, blue and yellow, are not assessed by the Rapaport Report. Often, coloured diamonds are more expensive due to their scarcity. Their price fluctuates according to supply and demand.

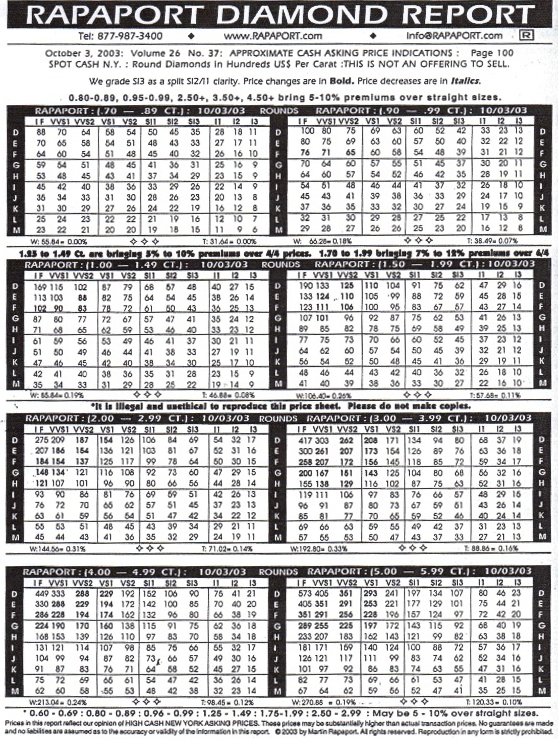

The Rapaport Report contains different tables that define lists of prices for each combination. The Rapaport Report is available with a subscription. The document is printed on a red background in order to prevent and limit photocopies. The price lists are established according to the weight, shape, colour and clarity of the diamond. Each grid has two boxes, and in each box is a number (2 zeros must be added) that indicates the price of the diamond per carat in $ USD.

Here is an example of the Rapaport Diamond Report :

Why invest in diamonds ?

Theinvestment should concern quality stones that will remain a reference value. Investment diamonds are of course subject to HRD, GIA or IGI certification, all of which have an excellent reputation in Europe.

Uncertainties linked to the stock market and economic conditions encourage investments in safe havens, such as gemstones. Investing in diamonds means holding assets in $ USD, which is very promising in the current period when Europe is in a downward phase at all levels.

Our job is to advise you and assist you so that you can invest or sell stones with the greatest confidence and in your best interests. You will have access to RAPAPORT which permanently provides details of diamond prices so that you can track your investment.

We would be pleased to welcome you in our offices in Paris and Antwerp to discuss investments or jewellery creation, which is our secondary activity. A wide choice of stones will be presented in order to complete your own designs or our creations.

Calculating the price of a diamond

Below is an example of the calculation of the price of a diamond (At a jeweler’s shop) in different years depending on the characteristics specified below :

Round, 1.05 ct diamond, D colour, VVS2 clarity, excellent cutting quality with no fluorescence, GIA certificate :

In 2002, it was quoted at 10,200 USD per carat, therefore 1.05 ct x 10,200 = 10,710 USD

In 2006, it was quoted at 11,500 USD per carat, therefore 1.05 x 11,500 = 12,075 USD

In 2010, it was quoted at 16,500 USD per carat, therefore 1.05 x 16,500 = 17,325 USD

In 2013, it was quoted at 17,600 USD per carat, therefore 1.05 x 17,600 = 18,480 USD

In 2014, the price went down to 17,000 USD per carat, therefore 1.05 x 17,000 = 17,850 USD

Diamond prices increased noticeably every year, except in 2014 and 2015 when they went down. However, prices recovered again in 2016 when an increase occurred on 15th January.

Being in possession of a diamond is also protection against a possible drop in the value of the Euro as diamond prices are set in US dollars.

If you are considering investing in diamonds, we recommend :

- Round diamonds only

- Colour : D or E

- Clarity : IF, VVS1 and VVS2

- Cutting quality : EXCELLENT at all levels (proportions, polishing, symmetry) or VERY GOOD

- Fluorescence: None, or minimal (“slight” or “faint”)

- Request that the stone be laser-engraved or sealed by the laboratory so that it is easy to identify.

French taxes at the time of sale are 6.5%; there is nothing to pay below the floor value of “5,000 Euro”.

We would be pleased to welcome you in our Paris, Antwerp or Geneva offices in order to discuss your investment plan or to present our stones, contact us !