Due to their characteristics and their scarcity, diamonds have always been a sound investment.

Investment diamonds are a safe haven

Their rarity gives them a very high value, in a very low volume. In comparison, a 1-carat or 0.2g diamond can have the same value as a 1 kg bar of gold. As is the case for gold, the value of diamonds increases naturally and regularly depending on depletion of the resource.

Diamonds are unalterable. Consequently, they require no special precautions and are generally kept in a safe.

Characteristics of investment diamonds

All diamonds increase in value over the years but only diamonds of an exceptional quality really stand out in terms of added value.

The following are the quality criteria that are necessary if the diamonds are to be a good long-term investment :

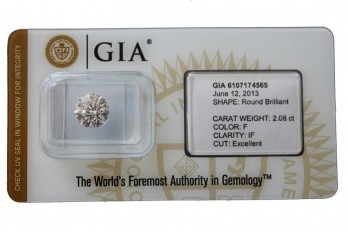

- The weight of diamonds : 1 carat and above

- The shape of diamonds : Round brilliant cut

- The colour of diamonds : from D to F

- The clarity of diamonds : from IF or LC (Loupe Clean) to VVS2

- Proportions, symmetry, polishing : Very Good or Excellent

- Fluorescence : None or Slight/Faint

Diamonds offer a number of advantages in terms of investment, inheritance and donations. Diamonds can be negotiated worldwide.

Investment diamonds require no management service. They are generally placed in a safe deposit box.

Please do not hesitate to contact us in order to discuss your investment plans.

Before making a secure investment in a diamond, you need to request different services from the merchant. These are outlined on the security when purchasing a diamond page.

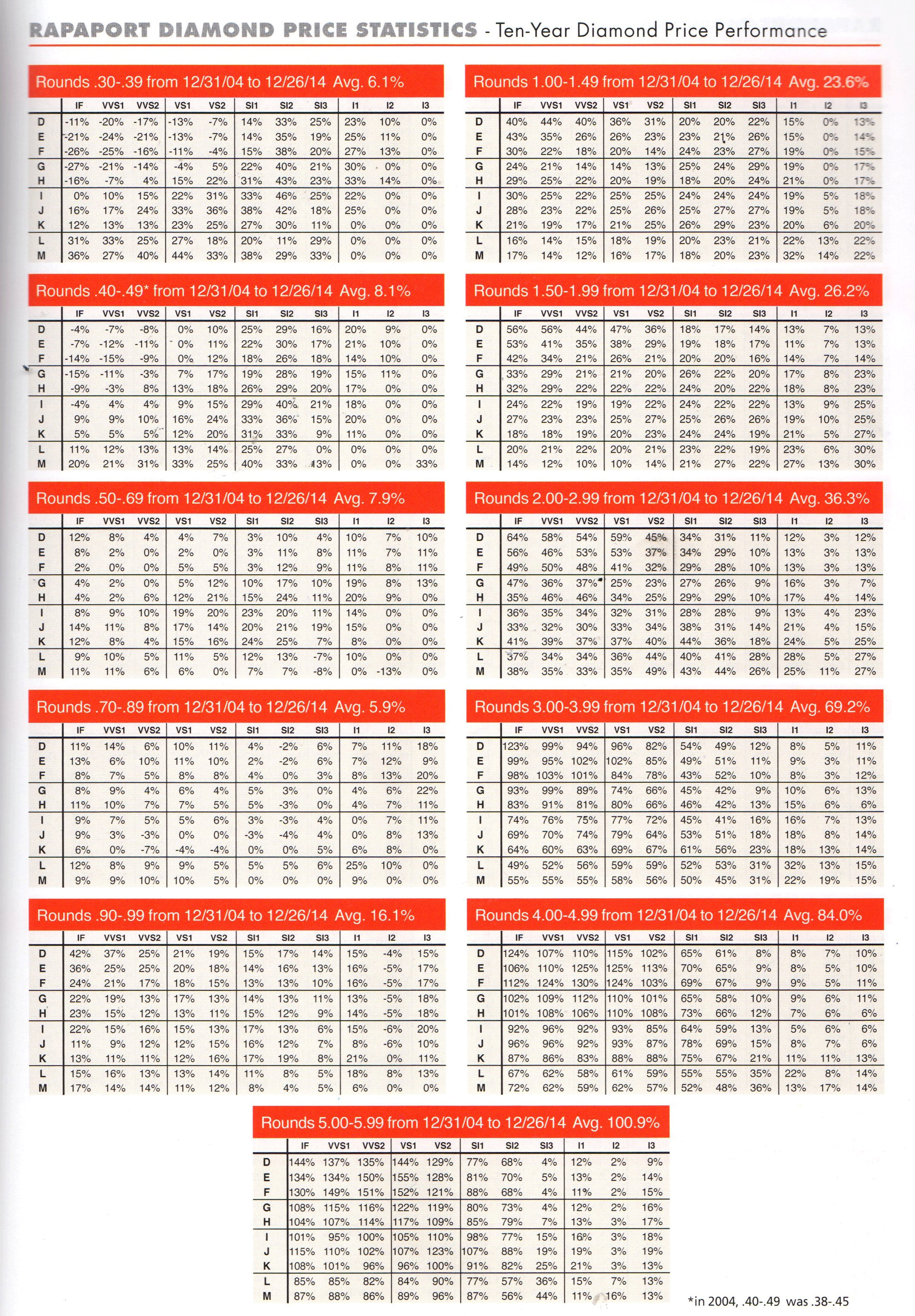

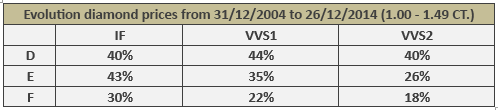

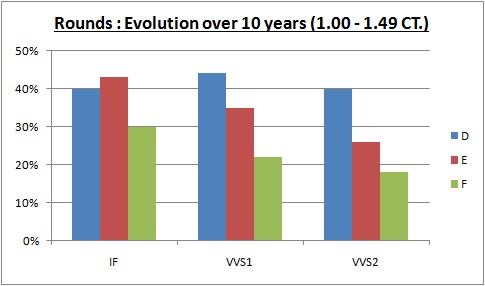

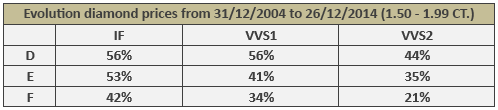

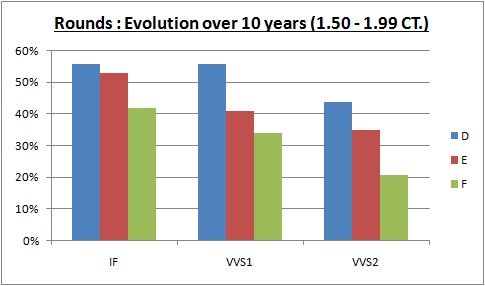

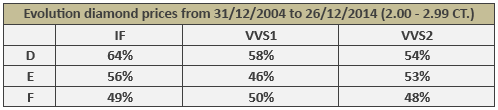

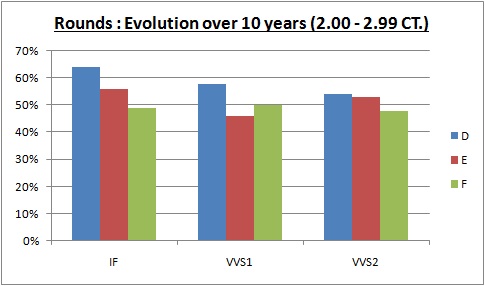

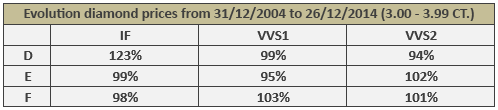

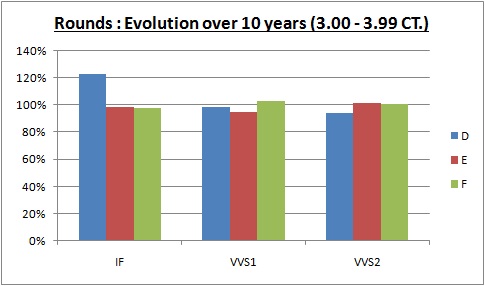

Below, you can see the progression of diamond prices, depending on their qualities compared to 10 years ago. The best returns were from a round, 3-ct diamond with D colour, IF clarity, very well cut and with no fluorescence whose value increased by 123% over 10 years

Source : Rapaport Vol.38 No.1 January 2015 “30+ Years of Diamonds Prices”

In its January 2014 edition, the magazine Gestion de Fortune devoted an article to investment in diamonds. Here is an excerpt: “For Nicolas de Saint-Yvi, director of Diamant-Gems ‘diamonds for investment are those that have the highest ratings in terms of colour, clarity and size […] an individual who purchased a high-quality investment diamond in 2010, kept it sealed in a safe for two years and sold it in 2012, made a capital gain of 15 to 20 %”.

Click here to download the full article (in French). To learn more about investment diamonds, you can consult our case study : Investment diamonds.

You might also like to read the following article published in the newspaper Le Monde, regarding the trend in investment of diamonds for 2013 (in French) :